Business Case for Industry

Please note that this content is under development and is not ready for implementation. This status message will be updated as content development progresses.

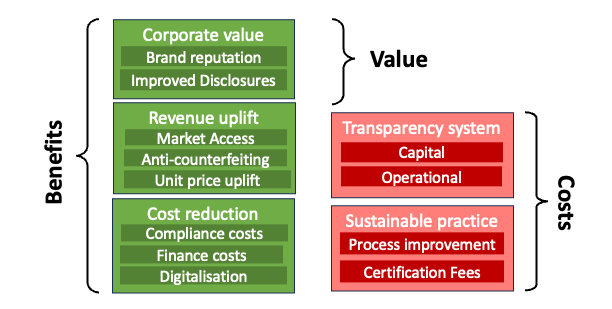

The decision to implement UNTP needs a positive business case to justify the investment. The purpose of this page is to provide a framework for business case development. We provide a generalized cost / benefit model and then discuss its application to specific roles and industries. We also provide a separate cost benefit model and business case template for regulators.

Note: The economic impacts described in this document are projections based on available data and economic models. Actual results may vary. Regular monitoring and evaluation of the UNTP's effects are recommended to assess its efficacy and guide any necessary adjustments to the protocol.

Industry Cost Benefit Model

The high level model shown below breaks benefits into three categories and costs into two categories.

- Benefits accrue through increasing revenue and/or decreasing cost. Improved margins that result from that of course contribute to corporate value but there are also less tangible benefits at the corporate level such as brand reputation.

- Costs are incurred through changes to production processes to achieve greater sustainability and the implementation of traceability & transparency systems to communicate that verifiable sustainability.

Actual benchmarks for benefits and costs by industry sector and geographic region will become increasingly available over time through the UNTP Value Assessment Framework (VAF). At this point in time, benefits and costs are described qualitatively and supported with metrics from public research.

Benefits - Revenue Uplift

Market Access

Legislation increasingly requires companies to prove ESG credentials to be able to trade in certain countries. Examples include the EU Deforestation Regulation EUDR as well as several due-diligence regulations such as the EU CSDDD and US UFLPA. Legislation effectively put pressure for on buyers to prove provenance and sustainability requirements for certain products, as well as a higher burden of truth from suppliers from to certain regions. In many cases, these regulations reverse the burden of proof - namely that companies must prove that they are compliant in order to maintain market access. UNTP based transparency allows companies to keep trading in said areas, rewarding suppliers ensuring good practices rather than being forced outright out of these markets.

- Quantification. The percentage of revenue that is either retained or increased will depend on the commodity and footprint of any given supplier in a regulated market. The value of imported goods impacted by EUDR is approximately $400Bn which is around 1.2% of world trade. The volume of trade impacted by Due Diligence acts is similar or larger than EUDR.

- References. EU market import volumes, Krungsri EUDR impact analysis,

The impact of these trade barriers for any given company will be between 0% and 100% of revenue depending on which commodities they sell to which market. But given the collective impact of between 2% and 3% of world trade, an average benchmark of 1% of revenue seems conservative.

Unit Price Uplift

Consumers are increasingly selective about product choice based on believable sustainability criteria. There are several surveys that indicate around two-thirds of consumers consider sustainability in product choices and that around one third are willing to pay a premium. The amount of the price premium varies widely and there is evidence that consumer behaviour change is slow and sometimes only temporary. There is also evidence that rich data (for example UNTP DPPs) drives stronger behaviour. The amount of end product price increase that flows through to the upstream supply chain is more difficult to quantify but may be very limited. Nevertheless, if buyers select supply based on sustainability criteria then non-conforming suppliers and products are likely to be forced into lower-priced commodity markets. Buyers tend to be reacting more quickly than suppliers to these demands, as a result, moving forward it is likely that there will be a shortage of suppliers able to deliver products with satisfying ESG credentials. Buyers who are able to sign long term contracts today and develop partnerships with aligned suppliers will have a considerable price advantage compared to market laggards.

- Quantification Estimates of the average sustainability premium that consumers will pay vary widely from around 1% to 12%. If 30% of consumers are willing to pay a 5% premium then the overall unit price impact is around 1.5%.

- References. Consumer high estimates, Consumer low estimates.

The unit price uplift for verifiable sustainable goods will vary widely depending on commodity and market. However an average benchmark of 1% seems reasonable and conservative.

Anti-Counterfeiting

Global trade in counterfeit goods is estimated at between 2% and 5% of trade. The most impacted commodities are pharmaceuticals and luxury goods including quality wines & spirits. The volumes increase when pirated / smuggled goods are taken into account including illicit tobacco into high tax markets. What is more difficult to quantify is the proportion of counterfeit goods that are un-knowingly purchased as genuine goods since, in many cases, buyers of fake luxury goods or illicit tobacco make purchases knowing that the goods are fake or pirated. UNTP offers a simple but effective anti-counterfeit protocol that works well when buyers are motivated to confirm that goods are genuine.

- Quantification. 4% of global trade represents about $1.2Tn in counterfeit goods. If approximately 50% of that trade can be impacted by improved anti-counterfeiting measures then the average value is around 2%. If the effectiveness of anti-counterfeiting measures is estimated at 50% then the value falls to around 1% of trade.

- References. OECD trends in counterfeit goods, USTPO counterfeit estimates.

The value of sales recovered by reductions in illicit goods will vary from 0% for commodity goods to as much as 10% for pharmaceuticals and some luxury goods. A benchmark value of 1% industry-wide seems reasonable and conservative.

Benefits - Cost Reduction

Compliance Costs

Regulatory compliance costs encompass the administrative burden of reporting, processing fees, tariffs, border clearance delays, and penalties. As sustainability regulations increase, these will be more rigorously enforced at borders, likely resulting in higher compliance costs. The UNTP offers customs authorities and corporate regulators higher confidence data, which can streamline border processing, reduce administrative costs, and minimize delays. As countries advance towards net zero commitments and implement domestic carbon pricing, it is increasingly likely that more countries will impose carbon border tariffs, such as the planned EU Carbon Border Adjustment Mechanism (CBAM). High-quality evidence of a low carbon footprint via UNTP Digital Product Passports (DPPs), along with full traceability, can help importers prove compliance with the EU rules of emission estimation, and reduce the burden of data collection and management for tariff treatment. Additionally, high-quality evidence of conformance of imported goods reduces the risk of punitive non-compliance fines. Importers with traceable, high-quality data can ensure that they are only paying CBAM charges on actual emissions. Without accurate data, importers might overestimate emissions, leading to higher costs. Detailed tracking allows them to minimize over-payment and reduce their carbon liabilities if the carbon price effectively paid in the export country can be deducted.

- Quantification. The compliance cost under CBAM, a steel producer with a high emission profile, might face a carbon levy in the range of €50–€90 per ton of CO₂ emitted, depending on current EU ETS carbon prices. High-quality evidence of carbon price paid in the export country can substantially adjust that value.

- References. EU Carbon Border Adjustment Mechanism, Wood MacKenzie CBAM Analysis

Finance Costs

UNTP provides a framework based on international standards which can accommodate different ESG risks, enabling development banks to standardize their reporting and ensuring their mandate, without having to create ad-hoc structures for each Sustainable Supply Chain Finance Deal. This unlocks a significant trade finance gap, and enables preferential finance to reach deep-tier suppliers. Access to lower financing costs for suppliers results in lower cost of goods sold and improved margins. These trade finance arrangements often come with grants that can support costs associated with the ESG transition, such as support certification, consulting or implementation of new ERP systems for reporting.

Access to Trade Finance

The Asian Development Bank (ADB) estimates that the global trade finance gap was approximately $2.5 trillion in 2022, up from $1.5 trillions in 2016 with a significant portion attributable to SMEs applicants, lack of visibility, and issues with country risk, credit-worthiness and lack of sufficient information by the applicant. At the same time, Supply Chain Finance (SCF) has grown from $330 billion in 2015 to $1.8 trillion in 2021, despite this growth, SCF has has not yet had a major impact in reducing the trade finance gap due to difficulty reaching past tier 1 suppliers. By adopting the UNTP, this gap can be reduced by enabling more companies to access preferential financing thanks to increased visibility over ESG credentials and ability to provide identity assurance from a trusted register, combined with SCF reverse factoring operating models which reduce applicants risk by tying the financing to the buyer credit risk.

- References Asian Development Bank (ADB), Trade Finance Gaps Growth and Jobs Survey 2021, Trade finance gaps growth jobs survey 2023. Deep-Tier Supply Chain Finance 2022

Reduced Finance Costs

According to the International Finance Corporation (IFC), companies that adopt sustainable practices can reduce their financing costs by up to 20% due to lower risk premiums and better access to capital.

- References International Finance Corporation (IFC), "Sustainable Finance: Creating Value for Companies and Investors," 2020.

Improved margins

A study by the Global Reporting Initiative (GRI) found that companies with strong ESG performance can achieve up to a 10% improvement in profit margins due to enhanced operational efficiencies and lower financing costs.

- References Global Reporting Initiative (GRI), "The Business Case for ESG: How Sustainability Can Drive Financial Performance," 2019.

Cost of Goods Sold

A report by McKinsey & Company indicates that companies with optimized supply chain financing can reduce their cost of goods sold by 5% to 10% due to lower financing costs and improved supply chain efficiencies.

Digitalisation Efficiency

Digitalisation through UNTP enables automated data collection and processing, reducing manual labor and errors. This leads to streamlined operations and faster decision-making. Enhanced digitalisation provides real-time visibility into supply chain activities, allowing for better inventory management and demand forecasting. Access to accurate and timely data enables companies to make informed decisions, improving overall business performance. Finally, digitalisation allows for better tracking of product quality and delivery times, leading to improved customer satisfaction and loyalty.

Digitalisation as a whole of organisation initiative can deliver a 10% to 20% reduction in operational costs due to automation and improved data accuracy. Improved supply chain visibility can reduce inventory holding costs by 15% to 30% and decrease stock-outs by 20%. Data-driven decision-making can increase productivity by 5% to 10% and enhance profitability by 3% to 5%. Enhanced customer satisfaction can lead to a 10% increase in repeat business and a 5% boost in overall sales.

- Quantification The digitalisation cost savings are for enterprise wide digital transformation. A smaller but significant proportion of those savings could be allocated to digitalisation of supply chain traceability & transparency through UNTP implementation. A 1% reduction in operating costs is a conservative estimate.

- References McKinsey & Company reports on digital transformation, Deloitte insights on operational efficiency. Gartner reports on supply chain visibility, Accenture studies on inventory management. Harvard Business Review articles on data analytics, PwC reports on data-driven strategies. Forrester Research on customer experience, Bain & Company studies on customer loyalty.

Benefits - Corporate Value

Brand Reputation

Transparency in supply chains builds consumer trust, as customers are increasingly concerned about the ethical and environmental impact of their purchases. Companies that can demonstrate their commitment to sustainability and ethical practices are more likely to gain consumer loyalty. Companies with strong ESG credentials often see an increase in brand value. This is because consumers, investors, and other stakeholders perceive these companies as more responsible and forward-thinking. Companies that adopt the UNTP can differentiate themselves from competitors by showcasing their commitment to transparency and sustainability. This can lead to a stronger market position and increased market share. Finally, transparent supply chains help companies identify and mitigate risks related to unethical practices, environmental violations, and other ESG issues. This proactive approach can prevent reputational damage and associated financial losses.

Studies reveal that over 50% of global consumers and over 75% of millennials are willing to pay more for sustainable brands. Also that over 80% of consumers will purchase a product because a company advocated for an issue they cared about, and over 70% will refuse to purchase if they find out a company supports an issue contrary to their beliefs. Brands with high ESG scores have been found to achieve a brand value premium of up to 10%. Brands with strong reputations recover more quickly from crises, with a 5% to 10% faster recovery in stock prices.

- Quantification. The brand value benefits listed above will accrue for companies that place sustainability at the center of their corporate strategy and implement a range of measures. UNTP implementation is only one measure but will add considerable trust to sustainability claims and can therefore conservatively account for a 1% increase in brand value.

- References. Nielsen, "The Sustainability Imperative: New Insights on Consumer Expectations," 2015, Brand Finance, "Global 500 2020: The Annual Report on the World's Most Valuable Brands," 2019. RepTrak, "Global RepTrak 100: The World's Most Reputable Companies," 2019. Cone Communications, "2017 Cone Communications CSR Study," 2017.

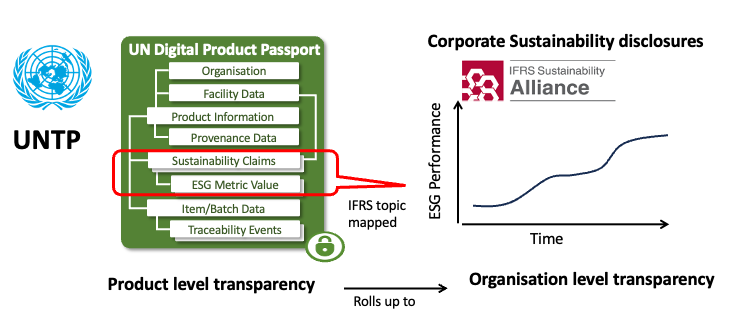

Improved Disclosures

Regulations that mandate annual corporate sustainability disclosures are being drafted or already in force in most economies. They generally require reporting of concrete metrics such as CO2 equivalent emissions and almost all include scope 3 emissions (ie emissions associated with upstream supply. The World Business Council for Sustainable Development (WBCSD) defines a generic model for emissions reporting and highlights the fact that, for most companies, scope 3 emissions represent around 70% to 80% of their emissions footprint.

We have included a separate category for corporate disclosures because there is a serious problem facing most corporates today. The problem is that most corporates simply do not have the data from their upstream suppliers to directly measure their scope 3 emissions footprint. Therefore the only viable option is indirect measures such as using industry average intensity for each input product or material. Without direct information from suppliers there is no mechanism to select lower intensity supplies - and, correspondingly, there is no incentive for suppliers to reduce their emissions. Corporates that increase sales volume year on year are therefore likely to also report increased emissions (increased volume multiplied by an unchanged industry average). Companies that show deteriorating emissions performance are likely to be punished through reduced consumer loyalty, reduced brand value, increased border tariffs, and reduced access to finance.

Direct measures of supplier sustainability performance through UNTP digital product passports will provide corporates with the means to select more sustainable supply and therefore directly improve their own aggregate performance year on year.

- Quantification. The same metrics as apply to brand reputation apply here.

- References. WBCSD Pathfinder 2.0 Framework

Costs - Sustainable Practices

Process Improvement

Suppliers are often requested to bring ESG improvements based on the materiality matrix of their buyers, so as to align with the buyers ESG strategic priorities: Examples may include: Reducing carbon emissions of particular energy intensive processes (i.e. by adopting less energy intensive processes or switching to renewable energy sources) Reducing or eliminating the use of harmful chemicals in heavy industrial processes Improving human or labour rights issues within their supply chains These improvements are often costly, which are often absorbed by loans. Green finance mechanism can help reduce the financing cost of these improvements, and are often related to these improvements, while the establishment of long term contracts with buyers can on the one hand secure cash flow for suppliers to absorb those costs over the years, while on the other guarantee to the buyer the flow of conform goods.

- Quantification.

- References.

Audits & Certification

Suppliers that improve their processes towards sustainability practices have three ways to prove their credentials to their buyers, namely carrying out a self assessment, being audited by the buyers and being audited and certified by a third party, the latter of which carries the greatest weigh in terms of credibility, both for voluntary improvements and certainly for regulated ones. These certifications and audits often need to be made for each ESG risk where mitigating actions have occurred, with certifications starting in the 5 figures for each certification type.

- Quantification.

- References.

Costs - Transparency System

Establishing a transparency systems along a supply chain carries its own costs in the form of consulting fees to map and study the structure and processes and actors involved in a specific supply chain, the data elements of it and how those conform to an interoperability protocol such as UNTP as well as software and IT integration and adaptation costs, all of which is expected to range in the six figures. It also carries costs to run such a system on a day to day basis. At the same time, UNTP’s principle is to use what is already available and being used, or planned to be used, by participants, rather than buying new software; once implemented we expect the operational costs to be in a similar range to what existed before hand, with any additional cost related to additional features related to benefits which the industry might require.

Capital investment

In order to adapt a digital ecosystem to an interoperability protocol such as UNTP, adopters will likely rely on consulting companies to assess the supply chain, identify data elements, and evaluate compatibility with UNTP standards and may decide to rely on consultants also to project manage and implement the project. Equally buyers will need to integrate their systems with their suppliers systems, or decide to commonly use a system that conforms to UNTP.

- Quantification.

- References.

Operational costs

As a UNTP complaint system set up is designed to work with what is already available, we expect adopters to get back more for the same resources they were already using for transparency purposes AUTOMATION, COST SAVINGS.. At the same time, the wealth of information resulting from full traceability will likely drive adopters to capitalise on their investment and add resources to analyse and disclose their supply chain data where they see a return.

- Quantification.

- References.